THE CONTENTS OF VOICE AND NOISE

The World Bank Group? (WBG)/ The Executive Directors?/ The Nongovernmental Organizations? / The Millennium Development Goals?/ 205 Development Topics! —listed on the World Bank Web site

My ED trips 1

Why was it such an issue for me?/ A word of caution about Financial Leverage/ An Unsustainable Sustainability/ Odious Debt/ Odious Credit

BASEL—Regulating for what? 37

Puritanism in banking/ A warning/ About the Global Bank Insolvency Initiative/ Some comments at a Risk Management Workshop for Regulators / Let the Bank Stand Up/ BASEL and microfinance / The mutual admiration club of firefighters in Basel / Towards a counter cyclical Basel? / A new breed of systemic errors

The debate about using Country Systems 55

Why did I spend so much time on this issue?/ Let them bike/ About El Zamorano and the use of country systems/ Lost in the water of globalization

My very private fight for better privatizations 65

Where do I come from?/ Transmission and Distribution—T & D/ Electricity for Brazil—and Isla de Margarita what?/ Pay now and pray for the light/ Hit in the head by the SENECA sale/ The present value and short circuits/ Reform fatigue opportunities/ Fiscal Space—Public or Private

About indexes and their disclosure 83

About indexes and their disclosure / The Riskiness of Country Risk / Disclosing the IDA Country-Performance Ratings / US GAO Report

A bit on some other indexes 95

The through-the-eye-of-the-needle index/ The index of perceived Corruption/ Today, let us talk about the bribers/ A dangerously failed index/ How good or bad is your municipality?

EIR & Environment 107

My answer to the NGOs/ The Amazon/ Our quixotic windmills/ Earth, the cooperative/ A better alternative than a hybrid

Oil 121

About an Oil Market Update/ It’s an oil boom, stupid!/ Kohlenweiss 1979/ The search for transparency in an oil-consuming world/ We need the world price of gasoline (petrol)/ Sovereignty/ The Oil Referendum/ Why do they point their finger only at us?/ About accountability in energy planning

Trade, agriculture, services, and growth 135

On the road to Cancun…with new proposals/ Place us next to something profitable…/ Time to cover up?/ An encore on nudism and WTO negotiations/ Hosting the spirit of free trade/ Time to scratch each other’s backs/ Of Mangos and Bananas / Local strawberries in season

About remittances and immigration 147

The nature of remittances/ Remittance fees: The tip of the tip of the tip of the iceberg/ What GDP?/ Family Remittances/ Some notes on the securitization of remittances/ Safeguarding resources/ Scaling up imagination about immigration/ The Skin of the United States/ A de-facto USA enlargement

About cross-border services and emigration 165

The prisoners, the old, and the sick/ A wide spectrum of services for the elderly/ The ethics of solving the shortage of caretakers/ Are we truly a World Bank?/ Get moving!

Intermission…Out of the box tourism 173

Lessons from Florence/ A niche in crookedness?/ Dead and Useful/ Adventure tourism/ Vanity tourism/ Guaranteed boring

On our own governance 181

A real choir of voices/ Voices, Board Effectiveness, and 60 Years/ WB-IMF Collaboration on Public Expenditure issues/ The Normal Distribution Function is missing/ Board Effectiveness and the ticking clock/ WBG’s fight against corruption/ The Annual Meetings Development Committee Communiqué/ Hurrah for the Queen/ Diversity/ About the board and the staff/ A very local World Bank or…the not in my backyard syndrome

Budgets & Costs 193

On the urgency and the inertia of our business/ Medium Term Strategy and Finance Plan/ Unbudgeted costs/ Budget tools/ The remuneration of our President/ About our central travel agency

Reshuffling our development portfolio 201

Let us scale up the IFC / An encore on the BIG capital increase for IFC / The Multilateral Investment Guarantee Agency—MIGA

On some varied homespun issues 209

The Poverty Reduction Strategy/ There should be life beyond 2015/ There should be new life beyond HIPC/ We need to make more transparent our harmonization/ Transparently Understandable Debt Management/ The Financial Sector Assessment Handbook —a postscript/ Too sophisticated/ About the addiction of guarantees to Municipalities/ About risks and the opportunities/ Financial Outlook and Risks

Some political incorrect Private-Sector Issues 219

Is the private sector the same private sector everywhere?/ Private vs. local investors/ Some thoughts about financial good governance/ What is lacking in the Sarbanes-Oxley Act./ Too well tuned?/ Alternative Millennium Development Goals

Communications 225

Communications in a polarized world/ Some other global communication issues/ Red and blue, or, red or blue?—a postscript

Some admittedly lite pieces 237

The World Bank Special / Thou shall not PowerPoint / Deep pondering on labels / To write or not to write…by hand / Three bullets on punctuality

On common goods and some global issues 247

Towards World Laboratories/ Daddy…the original or the copy?/ The rights of intellectual property user/ Who can enforce it better?/ Moisés Naím’s Illicit—a postscript/ Global Tax/ Labor standards and Unions

A mixed bag of stand-alone issues 259

My insecurities about the social security debate/ About the SEC, the human factor, and laughing/ Roping in the herd/ A paradise of customs illegalities/ Human genetics made inhuman / Justice needs to begin with just prisons - McPrisons/ Real or virtual universities?/ Brief thoughts on Europe/ Some spins on the US economy/ Is inflation really measuring inflation?

My Venezuelan blend 283

A Proposal for a New Way of Congressional Elections/ Let’s all whakapohane!/ We enjoyed/ Hugo, the Revolution, and I/ April 11-13, 2002/ To the opposition/ Synthesizing my current messages to my fellow countrymen/ 167-to-0—a postscript/ What is the financial world to do with Venezuela?/ Massachusetts, please show some dignity!/ Colombia & Venezuela

My Farewell Speech on October 28, 2004 299

Did the Minister do right? 305

And now what? 307

The President’s succession 309

My thoughts on the issue/ The OK Corral and the World Bank/ A letter to an another new American World Bank President

On some current books, a movie, and a future book 315

The World’s Banker by Sebastian Mallaby/ The End of Poverty by Jeffrey Sachs/ The Elusive Quest for Growth by William Russell Easterly/ The World Is Flat by Thomas L. Friedman/ The Pentagon’s New Map by Thomas P. M. Barnett/ And the Money kept Rolling In (and Out) by Paul Blustein/ Confessions of an Economic Hit Man by John Perkins/ The Constant Gardener and the UN/ The future very last book about Harry Potter

The last items in my outgoing tray 329

Pray for us, Karol/ We must aim higher!

List of my fellow passengers who also dined at the captains table 333

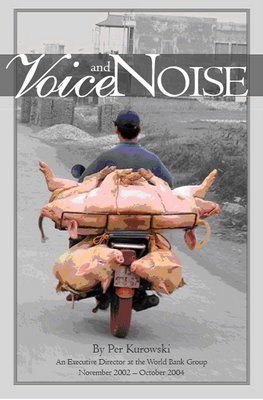

In search of a title

1/24th

By

One of twenty four Executive Directors of the World Bank Group

November 2002–October 2004

Some respectfully irreverent questions and suggestions about a great multilateral financial public-sector institution that the world needs more than ever to be a lean and mean poverty-fighting machine and that at sixty years of age should perhaps be renewing its vows in order to move up from “knowledge” into wisdom and instead of trying to advance impossible agenda like justice and social responsibility might do better settling for fights much easier to monitor against injustices and social irresponsibility … all made by a perhaps a somewhat naive but very well-intentioned former executive director equipped only with his long private-sector experience, and his willingness to speak out … sort of.

Or

HAVE THINK-TANK, WILL TRAVEL

Or

ANOTHER MOUSE WHO TRIED TO ROAR

Or

Mr. KUROWSKI GOES TO WASHINGTON (My daughter’s suggestion)

Or

VOICE AND NOISE

That’s it!

VOICE AND NOISE

Having an opinion and voicing it is what Voice is all about. Putting together thousands of perfectly pure voices might synthesize into a harmonious symphony but, without some noise, it will never ring true and that is what Noise is all about.

The world I remember when I was young moved forward on carrots and hope in the belief that it was going to be a better place, while today’s drivers are more the sticks and despairs of those looking only to hang onto what they’ve got.

To stand a chance of a better tomorrow, we need the Voice to recreate our dreams but also the Noise to make us want them come true.

A shrinking world that makes isolation impossible presents the human race with the challenge of really having to get along. If we resist facing this challenge, the world will be a much-saddened place: let me get off. However, if on the contrary we truly try to make it work, we will at least have some beautiful dreams again.

This book with all its simplicities and contradictions is but an effort to put my voice and noise on the table. All yours are needed too.

P.S. After having decided on the title I found on the Web an article by Ingo R. Titze, Ph.D., titled “Noise in the Voice” that originally appeared in the 2005 May/June issue of the Journal of Singing. It reassures me a lot, as it argues that “A little noise, turned on at the right time, can go a long way toward enlarging the interpretive tool."

The Chinese of China

The Nongovernmental Organizations? (NGOs)

An Unsustainable Sustainability

The latest fashion in the academic world of international finance is to calculate what is known as the Sustainable Debt Level (SDL). As you may have guessed, it has to do with the level of public debt a country can sustain without entering into a crisis. Normally the SDL is calculated based on the size of the economy (GNP) or on a country’s exports.

Whatever scientific approach is given to the SDL issue, it sure seems somewhat obscene to the citizenry of countries where it is evident that public debt engenders low or even no productivity.

If a credit is granted properly, the credit is repaid and then debt levels never become a problem. It is only the bad or mediocre loans that accumulate—those that do not generate their own repayment. So it could be said that what is really being calculated with the SDL is the level of bad debt that a country can get saddled with. Quite frankly, a developing country with real needs cannot afford the luxury of canceling even one cent in interest on a debt level arising from a series of credits that are nonproductive on the average.

From this perspective and since what we really mean is sustaining something that is unsustainable, this question remains: wouldn’t it be better to skip calculating this debt level and try to free ourselves once and for all from these mortgages, instead of condemning future generations to live forever under the weight of an SDL that has been perfectly calculated? How much torture can the torture victim take before passing out?

And who encouraged these countries to go into debt? Ask those who are well-acquainted with the temptation that credits pose to politicians. In China, they say that you wish for your enemies to live in interesting times. In Argentina, because of the suffering provoked by excessive debt, it would seem that what their enemies could have wished upon them was the trust and confidence of international markets.

On the day that our country Venezuela firmly and irrevocably sets upon the path of totally canceling its debt, on this day an enormous opportunity will open for all those private and collective initiatives that need financial oxygen. Unfortunately, it will not be easy, since our politicians, while condemning past debts, have mastered the magic of simultaneously preaching the benefits of new credits.

From El Universal, Caracas, June 5, 2003

Three bullets on punctuality

Time and human rights

I have no intention of putting the right to punctuality in the same category as the right to education, security, health care, food, and work.

However, in a country such as ours (Venezuela) where we because of sheer lack of punctuality can easily lose up to three hours per week waiting for something or another, this, over our average active life span of 55 years, adds up to around one year. As civil-rights organizations normally go ballistic whenever anyone is arrested without justification even for a couple of hours, I wonder how they let this pass.

There can be no doubt that the majority of our countrymen do, without any remorse whatsoever, blithely ignore the existence and purpose of the clock, and so it is evident that in terms of punctuality we need a total reform of our civil society. How do we achieve this?

One alternative would be the creation of a “Punctual Venezuela,” parallel to the actual one. For example, if we start to use a little symbol that could be printed on all invitations to those activities that really require punctuality at the risk of being either excluded from the event or publicly chastised, we could possibly begin to create some semblance of civility. This symbol could be a watch, but I’d rather leave that up to the specialists in advertising.

The interesting part of this alternative is that it would allow us to impose, as of today, a heavy public and social sanction for those who lack punctuality without having to request that “notorious and incurable sinners” kick the habit cold-turkey. Also, maintaining the option of a not punctual Venezuela alive would allow us to continue to humor those foreign visitors who with a tropical flare that rivals our best take every chance they get to free themselves from the yoke of punctuality.

From The Daily Journal, Caracas, June 11, 1999

###

About parallels and meridians

We have recently witnessed public spectacles such as the fight the United States has sustained with Europe about bananas. Perhaps the effect of global warming has been much greater than we suspect as it seems to have moved the parallels normally identified with Banana Republics northward.

However the meridians might have gone haywire as well. I often take my daughters to parties that begin at midnight, which to me simply seems like a real and crude version, in cinéma vérité, of Saturday Night Fever. I cannot but suspect that their generation has simply decided to substitute the East Coast’s meridian for that of the West Coast. Some of the television channels seem also to suffer from the same syndrome. Somehow, I always seem to go to bed at night watching their afternoon comics while, if I am not careful, my daughters could wake up with their XXX-rated after midnight material.

From The Daily Journal, Caracas, June 11, 1999

###

My daughter’s cult

She is rarely late but she is absolutely never ever a minute early. She follows that Just-In-Time cult that drives us inhumanely nuts.

###

My wife’s cult

She is never late, but she is absolutely never ever just in time. She follows that better-early-than-late cult that has made us use years of our life waiting in airport departure halls.

###

My reality

Being squeezed between the just-in-time cult and the better-early-than-late cult is probably one of the reasons why I have been harassed into developing a radical middle mumbo-jumbo philosophy.

My book, Amazon’s profits and the value of its shares

Then I discovered the existence of some new publishing facilities that allow a rookie book writer like me to outsource. As these new facilities print the book “on demand,” there is no need to invest piles of money in printing too many copies that would reflect the author’s general sense of optimism and that could only later end up as tombstones in memory of shattered dreams. Well, it so happens that the new-wave publisher I chose was recently acquired by Amazon and as the article has to do with that company, I also found the perfect excuse to include it … for a very worthy reason … that of shameless self-promotion.

As a financial analyst (which is what an economist frequently does for a living) I am especially proud of this article since it evidences how I managed and dared to question the whole dot.com boom, at its peak, just by doing some thinking on my own. Of course, now, with the profits Amazon should expect from its new investment … and my book, I guess that once again the sky should be the limit for them.

###

One brief note though about these new “on demand” one-at-a-time printing methods. With them it seems that what we know as “editions” first, second, third, will in fact disappear and this might negatively impact book collectors and rare-book stores. Will they disappear?

Not necessarily, since this method could make collection even more challenging as you could view each individual book as an individual edition and therefore be able to improve your collection by moving up few slots at the time, perhaps from the 12.834th to the 235th edition. Whatever, just in case, you better hedge your bets and rush out and buy a second copy of an early edition of this book.

Given that it is so easy and inexpensive to make changes to the book by using this publishing system, we could also have an incredible number of different editions which might make debates about the book much more interesting—in one, I would write in yellow, and in another, in blue, and so I might finally reach the green I am looking for— by seeding confusion. Then rare-book stores would have unlimited access to rarities.

###

VIRTUAL TULIPOMANIA IN New York City

The tulips planted all along Park Avenue were in full bloom in a kaleidoscope of colors as I read that the share price of one particular firm reached the skies in New York. Both things conspired to remind me of a book by John Kenneth Galbraith, A Short History of Financial Euphoria.

In the chapter “Tulipomania,” we read: “Speculation, it has been noted, comes when popular imagination settles on something seemingly new in the field of commerce or finance.” “. . . by 1636, a bulb of no previously apparent worth might be exchanged for ‘a new carriage, two grey horses and a complete harness.’” The value of one particular bulb, the Semper Augustus, would be the equivalent of US$ 50,000 at today’s prices! Everyone, from nobles to servants, speculated, cashing in their property and investing in flowers. Capital inflow inundated Holland. “In 1637, came the end.”

Now, April 1999, in New York, the share price of a company which initiated operations in 1995, has never registered a profit, has (according to management itself) no short-term possibility of doing so either, does not possess any major tangible assets, and has issued a management report in accordance to SEC rules and regulations in which it makes known a series of risks that would make any investor’s hair stand on end, trades at US$ 200 per share, up from US$ 10, only a year ago.

Evidently, the company that I believe has joined the rank and files of the “tulipomanias” sells books through Internet and to conclude as much it should suffice to analyze some of the risks the firm itself has enumerated in various reports.

The Internet is above all else a medium for the transfer of information and in this context, developing technology known as “shopping agents” will permit clients to quickly compare one company’s prices to those of its competition. This would seem to presage an eventual but fierce price war, an environment that is not exactly the breeding ground for profits that back the market valuation we are observing. The low cost of entry and the probability that sooner or later some efforts will be aimed at prohibiting any monopolistic controls of the Web are also factors which can make the advantages created by an early incursion disappear in a flash.

All this has nothing to do with the company itself and all that I’ve read about it makes me believe it is well managed and that it most probably has a brilliant future. The problem lies solely in the market’s irrational expectations. The company reported in 1998 total sales of US$ 610 million, a net loss of US$ 124 million and a book value (assets less liabilities) as of the 31st of December 1998 of only US$ 139 million. Today’s market value of the firm, equivalent to the share price times the amount of the shares issued surpasses US$ 33 billion.

Let us now have a look at its potential. Total book sales in the United States during 1998 were worth close to US$ 23 billion. If we assume that a profit margin of 8% would be reasonable, this would mean that there would be US$ 1.8 billion available to reimburse capital invested, both equity as well as debt financing. If we then, for the sake of simplicity assume an overall return of 10%, we can estimate the global value of companies that sell books in the United States in the order of US$ 18 billion. If our company that today commands less than 3% of market share eventually attains a whooping 20%, its value could then reach US$ 3.6 billion. Now double that to take into account the rest of the world and then double that again to take into account of its declared intention of adding other products to its line of products, and we will still reach only about a third of its current value.

As this Financial Euphoria seems to have infected many firms associated with the Internet, I conclude that this must be a modern version of the speculative Dutch tulips. I also conclude that both these and the real tulips thrive in New York in spring.